Debt can feel overwhelming, but it doesn’t have to define your financial future. Many people live with credit cards, loans, and other obligations without a clear plan, which often leads to stress, missed payments, and a constant sense of being behind. The good news? With the right strategy, you can take back control and start moving toward freedom from debt.

Step 1: Face the Numbers Honestly

The first step in building any effective repayment plan is to stop avoiding the numbers. Write down every debt you owe—credit cards, car loans, student loans, personal loans, even money borrowed from friends or family. Include the total balance, the interest rate, and the minimum monthly payment.

This can feel uncomfortable, but facing the reality of your debt puts you in a position of strength. You can’t create a strategy for what you don’t fully understand.

Step 2: Understand How Your Debts Impact Your Credit

Different lenders and services report debts differently, which can affect your credit score and borrowing power. For example, understanding the timeline for when Affirm reports late payments

can help you avoid unnecessary damage to your credit history. Staying informed about these details allows you to prioritize payments more strategically.

Step 3: Choose a Repayment Method That Fits Your Personality

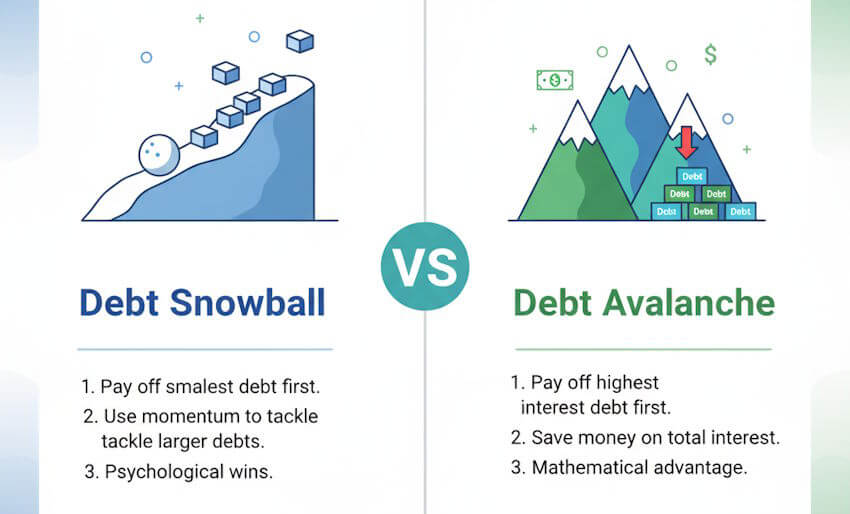

Not every strategy works for every person. Two of the most popular repayment methods are:

- Debt Snowball: Pay off your smallest debt first while making minimum payments on the others. Once the smallest is gone, move to the next. This approach builds motivation and quick wins.

- Debt Avalanche: Focus on the debt with the highest interest rate first, saving you the most money in the long run. While it may take longer to see results, it’s the mathematically efficient route.

The best method is the one you can stick to consistently. If you’re motivated by quick wins, the snowball might be right. If you want to minimize interest paid, the avalanche is your path.

Step 4: Automate and Simplify

Late fees and missed payments can undo months of progress. To avoid this, set up automatic payments for at least the minimum amount due. If possible, align your payment dates with your payday so the money never has a chance to get diverted elsewhere.

You can also consider consolidating debts into a single payment with a lower interest rate, which reduces complexity and makes it easier to track your progress.

Step 5: Cut Back, But Be Realistic

Creating a repayment strategy doesn’t mean stripping all the joy out of life. Instead, look for expenses that don’t bring much value and redirect that money toward your debt. Common examples include unused subscriptions, dining out too frequently, or impulse online shopping.

But don’t set yourself up for failure by eliminating every source of fun. A repayment plan should be sustainable over time, not a short-term crash diet for your finances.

Step 6: Track Your Progress and Celebrate Wins

Seeing your balances drop is powerful motivation. Track your journey with a simple spreadsheet, budgeting app, or even a paper chart on your fridge. Celebrate milestones—like paying off your first credit card or cutting your total debt by 25%. These small victories keep you going when the road feels long.

Step 7: Build a Safety Net

Once you start to get ahead, don’t forget to prepare for the unexpected. Setting aside even a small emergency fund prevents you from relying on credit cards or loans the next time life throws a curveball. Think of it as insurance for your repayment strategy.

Step 8: Shift Your Financial Mindset

Debt repayment isn’t only about numbers—it’s about reshaping the way you think about money. Ask yourself why you turned to borrowing in the first place. Was it a lack of savings? Emotional spending? Unexpected emergencies? Understanding your triggers helps you avoid falling back into the same cycle.

With each payment, you’re not just reducing debt—you’re building discipline, resilience, and financial independence.

Final Thoughts

Building a debt repayment strategy that works isn’t about being perfect. It’s about creating a realistic, sustainable plan and sticking to it over time. By facing your numbers, choosing a repayment method that fits your personality, automating where you can, and maintaining a positive financial mindset, you set yourself up for long-term success.

Remember: every payment is progress. Your debt doesn’t define you—it’s just one chapter in your financial story, and you have the power to write the ending.